Evelyn Zamora-Vargas came into college with an understanding of debit cards, interest and credit, but she was still missing some key ingredients for “financial literacy.”

Zamora-Vargas, a first-year student majoring in psychology and philosophy, said that even though she had an economics background from high school classes, GradReady — a new Pitt module to help teach first-year students how to manage their finances — helped her learn even more.

In terms of online banking, Zamora-Vargas said she learned about internet security phishing and how to recognize sites that could steal her information.

“With my basic understanding of finances, the module taught me how to spot a legitimate website,” she said, .

Zamora-Vargas is part of the first class of Pitt students who are required to complete GradReady. The module, which first-year students had to complete before August 26, taught them about debt, student loans, credit and budgeting through digital videos, online quizzes and interactive programs such as sample budgets and debt calculators.

According to John Fedele, a University spokesperson, the program is meant to advance educational excellence by promoting access and affordability for Pitt students, which is part of the first goal of The Plan for Pitt, the University’s overall strategic plan for academic years 2016-2020.

“By requiring financial literacy for incoming new students, Pitt is educating students as they begin their college career,” Fedele said. “This provides more time for students to make adjustments in their financial planning and spending.”

The module is meant to help students practice budgeting while in college and to learn about future expenses so they are prepared when they graduate. Most of all, it is meant to show them different options for acquiring and repaying student loans.

According to Great Lakes Higher Education Corporation — the company that provides the GradReady program — nationwide final exam scores for the module showed, on average, a 68 percent improvement in financial literacy over performance on the pre-course assessment.Although the GradReady module is only required for first-year students, Student Affairs, the Office of Admissions and Financial Aid and the Office of Student Financials is working to create a task force to expand the program for other students, according to Fedele.

For now, sophomores and upperclassmen can access financial literacy resources, such as information about credit reports and budgets, through the Student Payment Center.

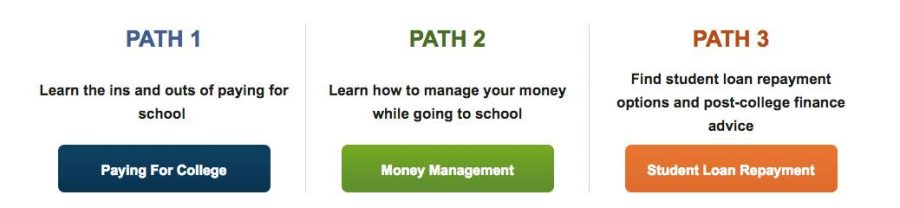

GradReady, which takes about two hours to complete, is designed based on three paths — the “paying for college” path, the “money management” path and the “student loan repayment” path.

The first path covers how to fund college education through watching and rating videos about the Free Application for Federal Student Aid (FAFSA), award letters, loan options and other resources. Students can also browse “borrowing options” and compare their financing plan to other available resources. Lastly, there is a tracker to estimate a student’s “debt-to-income ratio,” assessing whether their debt will be manageable, challenging or complex.

The second path focuses on banking basics, explaining banking services, choosing a bank and balancing an account through online videos. Students can also practice making a budget to balance projected income, budgeted expenses and actual expenses.

In the last path, the “student loan repayment” path, students learn about future finances, how to manage repayment and future expenses such as mortgages. They can also work with an electronic loan counselor to create a strategy for repayment based on the student’s current and their ability to pay.

Nationally, students are required to complete financial counseling before they receive a loan and as their academic career nears a close, according to Federal Student Aid, an office of the U.S. Department of Education.

Though college students may receive such counseling, American adolescents are still behind on financial literacy when compared to the worldwide average. According to the 2012 Program for International Student Assessment — the first large-scale international study on financial literacy among 15-year-olds — the U.S. ranked eighth among the 18 countries that participated. Globally, 15.3 percent of students did not reach basic proficiency in understanding financial literacy compared to 17.8 percent of American students.

Jay Sukits, a clinical assistant professor of business administration at Pitt, said when it comes to finances, it’s best to be prepared and have a strong savings plan.

“During the ‘70s and ‘80s, I’ve witnessed a lot of company mergers, which meant a lot of layoffs,” Sukits said. “I highly recommend students always having at least a six-month emergency fund and don’t touch it.”

At Pitt, other departments are also working to make sure students have the resources and the education to navigate student loans and financial decisions within and beyond college. As part of the Outside the Classroom Curriculum, students are required to complete at least one financial literacy program in the “Wellness” category.

During New and Transfer Student Orientation, Student Affairs at Pitt hosted a session on financial literacy called “Your Guide to Financial Success” for parents and students to learn about “short and long term impacts of effective and basic money strategies,” according to Fedele.

While Sukits didn’t downplay the importance of necessary expenses, he said students should also leave room for an aspirational goal, one that trumps the necessities.

“Whether it’s to attend a top 20 MBA program, buy a house or even a car, start saving now,” Sukits said.