Board votes to increase endowment transparency, continue gradual fossil fuel divestment

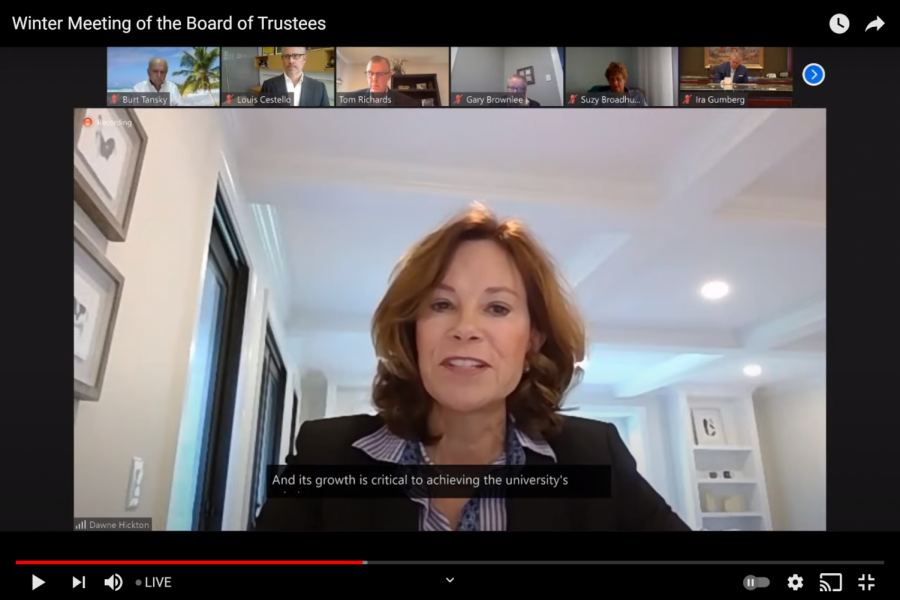

Dawne Hickton, the chair of the Board’s Ad-hoc Committee on Fossil Fuels, said the committee found that fossil fuel investments will pose a “higher risk” in the future.

February 26, 2021

Pitt’s Board of Trustees voted Friday to adopt all of the suggestions recommended by its ad-hoc committee studying whether and how the University should divest its $4.2-billion endowment of fossil fuel investments.

The committee released a report last Friday with the suggestions, and did not recommend that Pitt completely divest from fossil fuels in the near future and instead outlined strategies for continuing to reduce such investments. Student activists — including the Fossil Free Pitt Coalition, which has put pressure for years on the Board to divest — have decried the suggestions, arguing they do not meet the urgency of the moment. FFPC purchased a South Oakland billboard earlier this month that features two eyes and the words, “PITT THE WORLD IS WATCHING, DIVEST NOW.”

The actions adopted by the Board include:

- “Strongly support” implementing the University’s current Environmental, Social and Governance policy and directing endowment management to apply ESG considerations to every endowment investment decision.

- “Strongly support” the endowment’s current long-term investment strategy, which the report said will reduce private holdings in fossil fuel exploration and production to zero by the end of 2035.

- Direct the Board’s investment committee to oversee the development of a “long-term” strategy focused on seeking “attractive” investments that “help reduce, avoid and eliminate” greenhouse gas emissions.

- Increase transparency about the endowment, such as through “support” for Pitt’s commitment to release annual ESG reports, which will “highlight” the application of the ESG policy, in particular with fossil fuel investments, as well as “support” for “regular, clear and accessible University communication, education and engagement” about the endowment’s “aggregate status, trends and current and future fossil fuel” investments, including an annual update to the Board and University community.

- Not apply a “negative screen” — completely blocking one type of investment — to fossil fuel investments.

Dawne Hickton, the chair of the Board’s Ad-Hoc Committee on Fossil Fuels, said the committee found that fossil fuel investments will pose a “higher risk” in the future. But she said if Pitt were to completely divest right now, it would face a “significant financial loss” of $65 million to possibly more than $100 million in the case of immediate divestment.

“The ad-hoc committee did investigate what the cost to the University would be to sell these private investments early,” Hickton said. “But it’s a complicated type of investment and because set time frames are a feature of many private investments, the University would take a significant financial loss if it were to sell off faster in the secondary markets.”

Hickton added that the committee conducted 11 interviews total between nine subject experts, FFPC members and the University’s chief investment officer. She said the committee also considered 91 public comments — 77 for divestment, 11 opposed and three who had an unclear stance.

“Engagement with the University’s many constituents is an institutional priority and it has undoubtedly resulted in greater discourse about the University’s values and greater attention to issues of societal importance,” Hickton said. “In following the guidance in our charge, the ad-hoc committee worked in concert to conduct analysis and outline the issues in a nonbiased and balanced manner.”

In studying the investment environment for fossil fuels, the report also described it as “increasing risk for lower returns,” and noted that the endowment’s amount of fossil fuel investments has fallen dramatically in recent years. According to the report, fossil fuel investments have dropped by 42% over the last five years, decreasing from 10% of the endowment on June 30, 2015, to 5.8% — or about $243.8 million — as of June 30, 2020.

The committee added that “most” of the remaining investments in the fossil fuel industry are in private equity, which are expected to drop to zero by the end of 2035 as “these investments are liquidated by external fund managers and not replaced with others.”

Chancellor Patrick Gallagher said he wanted to “acknowledge” and “appreciate” those who participated in the discussion about fossil fuel investment — whether or not their “views prevailed.”

“It was very obvious through this process — and I could tell that the Board could sense this — that it’s hard to overstate the deep importance and urgency that our community feels about climate change and the impact it’s having on all of us as a planet but as an institution and as future leaders in the country,” Gallagher said. “I think that your advocacy, your effort and hard work has made a difference.”

Gallagher added that adopting the ad-hoc committee’s findings will be a “key part” of the University’s agenda moving forward. He said Pitt is in the process of creating its first “Climate Action Plan,” which the University plans to complete by the end of March. Aurora Sharrard, Pitt’s sustainability director, is leading the creation of the plan.

Pitt CFO Hari Sastry said Friday that he expects his office to release this summer its first report about how the University’s ESG policy is impacting the endowment, and acknowledged that his team is working to determine how Friday’s Board guidance will impact the report and the information it will contain.

Abhishek Viswanathan, a member of the FFPC, said the Board has “ignored the Pitt community’s overwhelming calls for divestment” while “[congratulating] themselves for spending time soliciting public comments.” Viswanathan said the climate crisis can’t be ignored.

“Now the committee has been dissolved and the University wants us to think the matter is resolved, but the climate crisis is already here and wreaking ecological havoc in our communities,” Viswanathan said. “Although the report acknowledges the extremely risky financial and environmental position that the fossil fuel industry currently occupies, it simply accepts the increasing risk as though our futures are simply incidental.”

Student Government Board President Eric Macadangdang and other SGB members have challenged the Board’s stance and supported a complete and immediate withdrawal of all fossil fuel investments in a letter addressed to the Board. Macadangdang said when SGB ran a referendum on the issue in 2019, roughly 91% of the 2,401 students who voted were in favor of divesting from fossil fuels.

While the committee’s report offers strategies for gradually reducing fossil fuel investments, Macadangdang said these tactics are not “aggressive nor purposeful enough” in fighting against the “crisis” that is currently at hand. While he offered many critiques on the ways forward offered by the committee, he did support those who called for the University to provide more transparency on fossil fuel investment trends.

Viswanathan said FFPC stands beside SGB in questioning the true purpose of the committee.

“The failure of this University to act is compounded by its propensity for performance,” Viswanathan said. “Unfortunately, Pitt’s marketing department or the now defunct ad-hoc committee on fossil fuels is not going to lead to the decarbonization necessary to ensure a sustainable and habitable future.”

Viswanathan added that FFPC’s fight for divestment isn’t stopping. Viswanathan said FFPC is “planning to take aim at the mechanisms and vested interests that allow the University to operate with opacity and impunity in the face of overwhelming community concern.”

“The University is deeply complicit in perpetuating injustices in all of those areas, and rebranding the obstacles they throw in our path as inevitable,” Viswanathan said. “We believe that a better world is possible, and we will continue to fight for it.”