Editorial: Forget damaged skin cells, tanning tax could hurt businesses

July 13, 2010

On those rare days when Pittsburgh’s weather permits laying out in the sun —… On those rare days when Pittsburgh’s weather permits laying out in the sun — meaning clear skies and temperatures that aren’t as excruciating as seen in early July — students in Oakland flock to lay out on the Schenley Plaza lawn and other such grassy locations.

Then again, Pittsburgh is notorious for its overcast skies. And who can forget last winter’s havoc-wrecking, record-breaking snowstorm? But the pale need not fear: Indoor tanning salons will keep that bronze body year round. That is unless the new tanning tax will deter you.

Earlier this month, a national 10 percent tax on ultraviolet indoor tanning services was instated. The tax will go toward the Patient Protection and Affordable Care Act. You’ve probably heard of the dangers of indoor tanning — skin cancer, premature aging and immune suppression, according to the Food and Drug Administration. While the risks continue to be debated, the dangers were enough to warrant a tax from the federal government. We’re used to Uncle Sam’s taxes on items deemed unhealthy — cigarettes and alcohol both carry sin taxes. But this tanning tax feels more biased than other taxes and could leave some businesses upset.

Opponents of the tax contend that even with any health risks associated with “fake baking,” tanning the old-fashioned way in the sun is hardly without risk. The casual tanner might not take factors such as cloud conditions and the daily UV index into account. Also, sometimes those looking for a little pre-vacation color can’t find the time to sit out in the sun. Even if they tan responsibly — meaning they avoid lobster-looking results — they still have to pay for something that can’t be obtained freely because of schedule, time or any number of constraints. With the tanning tax, of course, they’ll have to pay more.

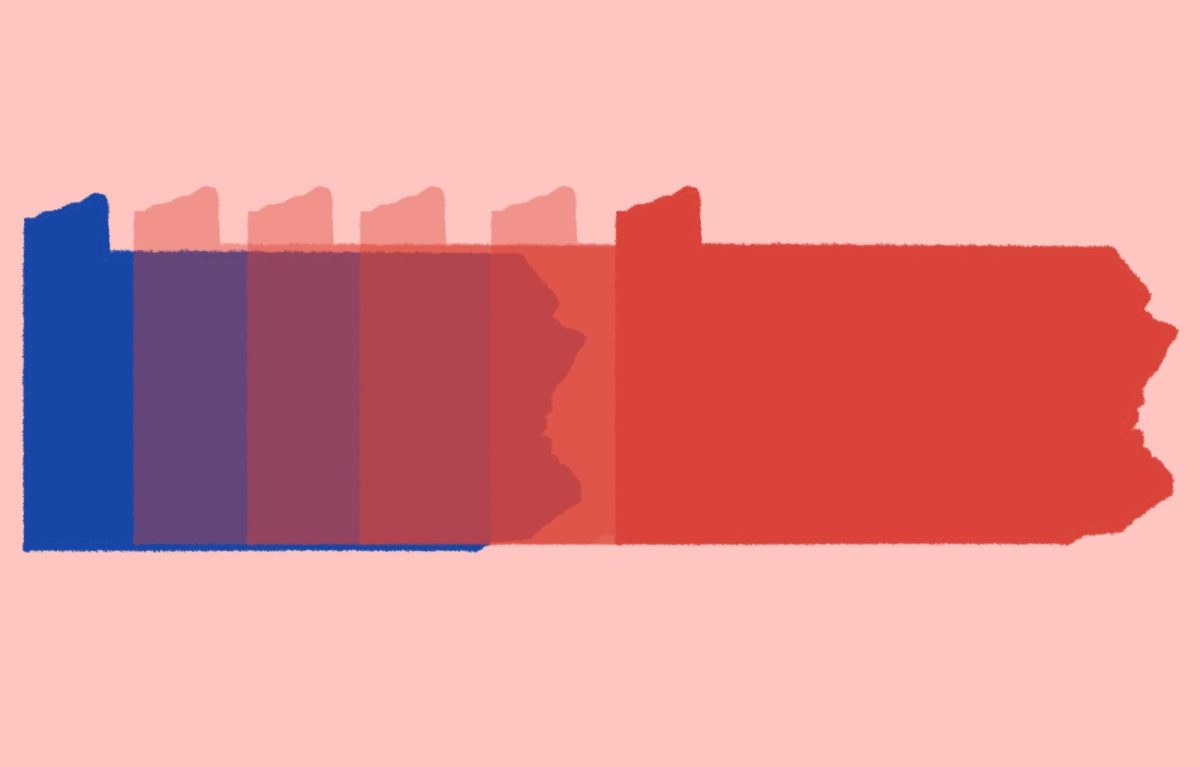

Pittsburgh just isn’t California. Or Florida. Oakland alone has a few tanning salons, and in areas with long winters and sparse sunshine, tanning salons are businesses that contribute to the economy just like any other. A 10 percent tax probably won’t run tanning venues out of business — although the 10 percent drink tax Allegheny County served up a couple years ago caused a real stir — but in a still-stagnant economy, more money means fewer customers.

Still, it’s hard to place a price on beauty. Those unofficially diagnosed with “tanorexia” probably won’t be willing to change their habits. The Congressional Budget Office estimates this tax could bring in $2.5 billion over the next decade.

But compared to taxes on cigarettes, there’s a critical difference in the tanning tax. Smoking is undeniably harmful to the health, yet whether it’s a convenience store or a gas station selling packs of smokes, cigarettes probably aren’t the only product offered. Tanning salons might sell bottles of tanning lotion or a collection of skimpy swimwear on the side, but those precious moments under the ultraviolet lights will always be their main draw. Taxing the featured product puts a strain on any business, and this tax is sure to leave some businesses feeling burned.