Editorial: Smoking tax puts tobacco to good use

March 30, 2009

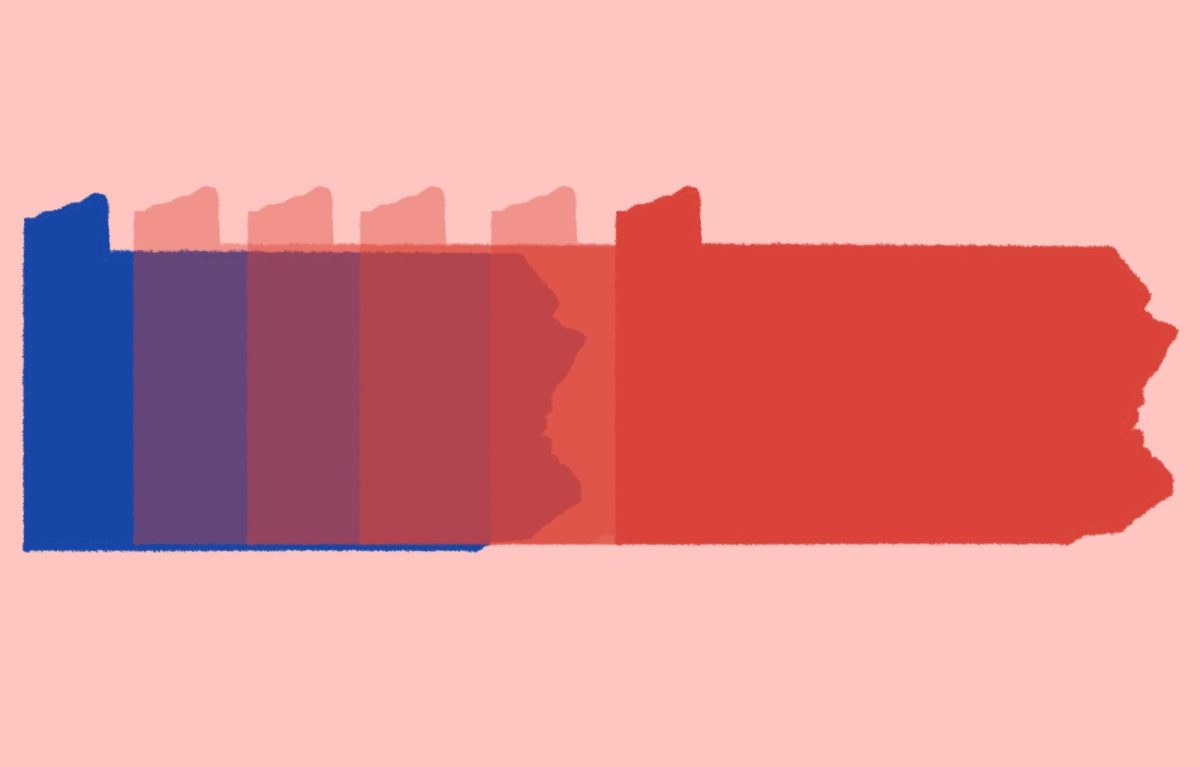

Smoking has taken a beating in public recently. From the widely criticized smoking ban in… Smoking has taken a beating in public recently. From the widely criticized smoking ban in Pennsylvania restaurants and workplaces to so-called ’15-foot’ rules that force smokers to stand a certain distance away from doors, it’s never been less popular to light up. And now being a smoker is going to cost a lot more, thanks to a 156 percent tax increase on packs of cigarettes.

On Wednesday, a new tax hike is set to take effect that will raise the per-pack tax on cigarettes from 39 cents to $1.01. Other tobacco products will see a significant bump in taxes, as well. The revenue from the tax will go toward funding a major expansion of health insurance for children through the Children’s Health Insurance Program.

Some people will argue that this places an undue burden on smokers, and that it isn’t fair to heavily tax a product to which many people are addicted. But the facts suggest differently, and a logical analysis of the problem bears this out.

The government has clearly established smoking as a public health risk. Smoking bans and 15-foot rules show a clear legislative preference for labeling secondhand smoke as a detriment to public health. Also, the health problems related to smoking drive health care costs up, increasing the burden for health care programs across the entire population, non-smokers included.

This tax represents what is known as a Pigovian tax, in which an activity that creates a negative external effect is taxed to balance out that negative effect in the market — or society in general. In this case, the negative health effects of smoking are being balanced out by a tax that is used to benefit children’s health insurance. One could see the tax as a way for smokers to pay their accrued debts to society for creating a health risk with their activities.

There’s also the added benefit that this tax could prompt more people to quit smoking now that the costs are significantly higher. A portion of people will always be willing to pay the extra money, but this tax could be a severe discouragement for a large portion of the smoking population.

In a way, this tax is really paying for itself twice: not only is it creating extra revenue for CHIP, it’s also reducing the public health costs of smoking by giving more people an incentive to quit.

Quitting isn’t always an easy prospect for people who smoke. To combat the possibility that people addicted to cigarettes — or any tobacco product — might not be able to handle it on their own, the government should also support an increase in the presence and availability of programs and materials designed to help people quit, such as telephone ‘quit lines’ and support groups.

In the end, the tax might be a burden to smokers. But smoking is a burden to everyone around who doesn’t smoke, and it’s only fair that the people responsible for creating that problem help shoulder some of the cost to pay it off.

‘