Allegheny County pours on the taxes

December 6, 2007

The day before the 74th anniversary of the passage of the 21st Amendment – otherwise known… The day before the 74th anniversary of the passage of the 21st Amendment – otherwise known as the repeal of prohibition – Allegheny County Council voted to adopt a new 10 percent tax on poured alcoholic drinks – a decision that represents how little our state has moved toward modernizing liquor legislation in the last three quarters of a century.

The new tax – which was approved along with a $2-a-day levy on car rentals – is earmarked for public transit, a service that has been floundering in Pittsburgh for years.

While we applaud any type of public discussion on how to save public transit – a valuable commodity that so many Pittsburghers take for granted – a tax on poured alcohol is just not the appropriate way to raise funds for public transit. Revenue being allocated toward public transit should come from taxes that give people an incentive to use mass transit, like the car rental tax. It just makes sense.

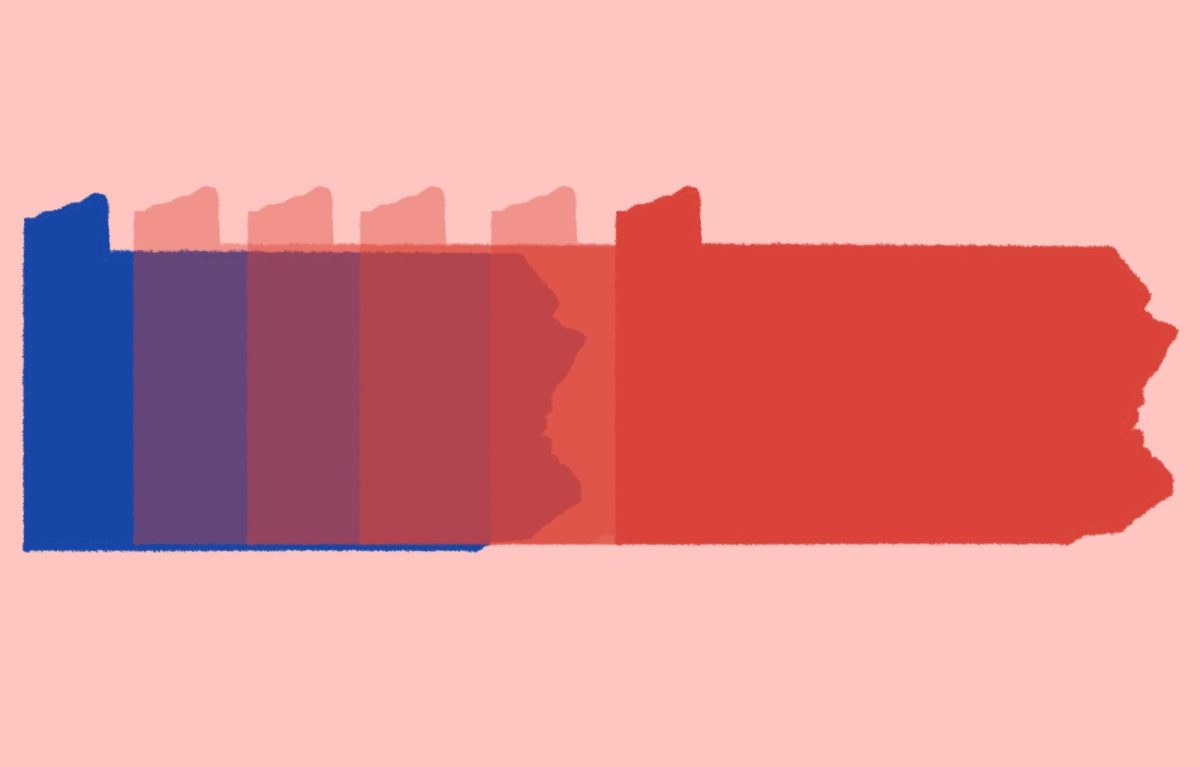

Poured alcoholic beverages are already subjected to an extensive amount of taxation in Pennsylvania. While we don’t always know it – the taxation is included in the price of the drink – bar patrons in Pennsylvania are currently paying a 30 percent markup tax, a $1.30 bottle charge, a “round up” tax, an 18 percent Johnstown Flood tax – which, incidentally, isn’t used for anything related to flood victims – and a 7 percent sales tax, according to the Pennsylvania Restaurant Association.

When it’s all said and done, that comes to a grand total of 81 percent in state-levied taxes. And that’s before any type of local taxation, like the new 10 percent poured alcohol tax.

And our local lawmakers wonder why young people aren’t staying in Pittsburgh?

The drink tax has come against the heated objections of local bar and club owners, who have already warned that the new tax will likely cause them to have to raise the price of drinks in order to avoid using nickels and dimes when changing drink orders.

Along with overtaxed consumers, the new tax will likely take another victim: our bartenders and restaurant servers. Think about it: If a drink costs $1, most bar and restaurant patrons leave $2 for the bartender. Now, the new poured liquor tax and a round up to the next quarter will bring the price up to $1.25. Most likely, bar and restaurant patrons will continue to leave $2 for their server – which creates, effectively, a 25 percent cut in tip. Multiply that by a night’s worth of serving, and the losses start to add up.

It’s been 74 years since we repealed prohibition, but sometimes it still feels like we’re still living in the moonshine era. There’s no alcohol in grocery stores, liquor and beer are sold separately and we are subjected to extensive amounts of taxation on alcoholic beverages.

For a city so concerned with keeping young people from leaving, why does it still feel like we’re being punished for ordering a drink?