Drinking tax wrong answer to public transportation deficits

July 9, 2007

As cash-strapped college students on a city campus, we can appreciate the value of both… As cash-strapped college students on a city campus, we can appreciate the value of both widespread public transportation and cheap drinks.

While the two services aren’t normally mentioned in the same breath, a proposal to tax drinks served in Allegheny County in an attempt to mend the Port Authority deficits has both restaurant owners and public transportation advocates buzzing this week.

County Chief Executive Dan Onorato has requested a Senate transportation funding bill that would grant county officials the authority to impose alternatives to raising property taxes to fund public transit.

And one of these alternatives could be a 10 percent tax on drinks served in restaurants, bars and clubs, according to the Pittsburgh Post-Gazette.

The proposal hasn’t exactly been a hit with restaurant owners – many have vowed to fight the bill, promising to have petitions in every restaurant within 48 hours of the bill’s passing – and rightly so.

While we do not currently pay a sales tax on alcohol served at restaurants and bars, the already sky-high prices imposed on bar and restaurant patrons can partially be attributed to a slew of state taxes covered by the restaurant. As it is, a $10 bottle of wine can cost upward of $18.

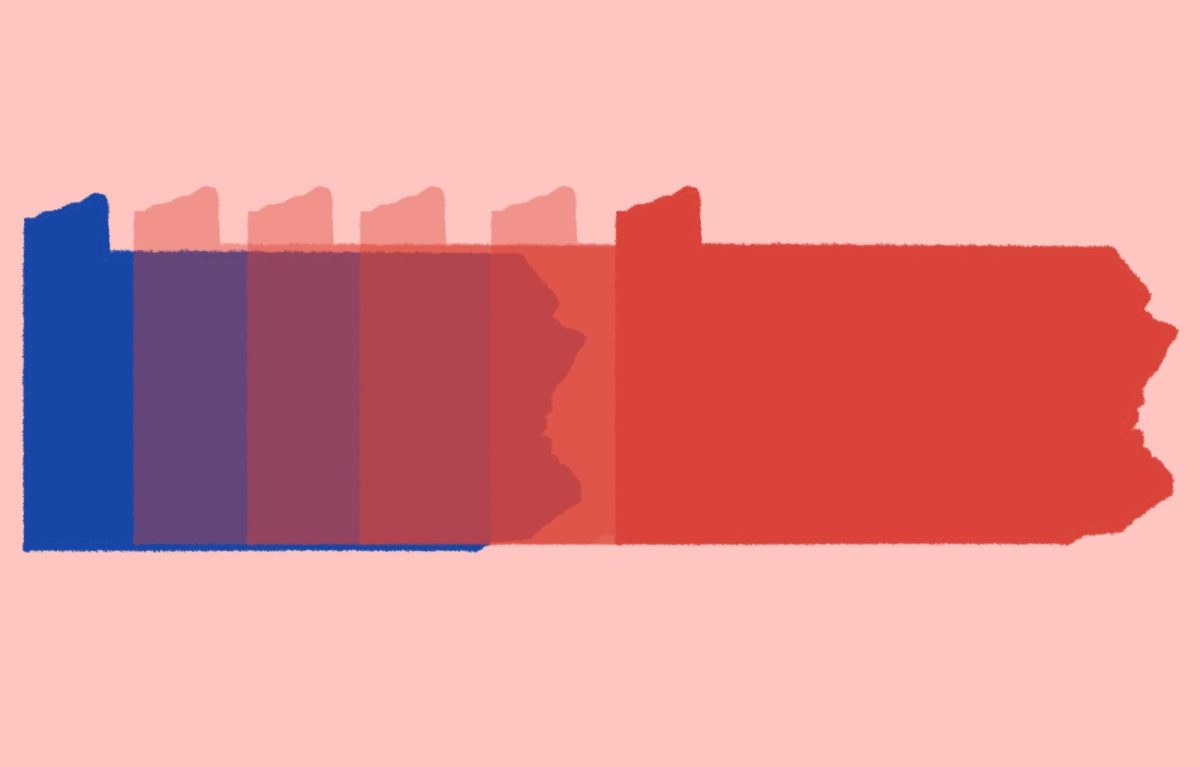

Adding a local tax to alcohol would only tack on to the existing alcohol taxation that currently exists in Pennsylvania.

And while the tax addition will be absorbed up-front by bar and restaurant owners, the burden will inevitably fall on consumers. We might actually see even more than a 10 percent increase, as bar and restaurant owners will likely round to the nearest dollar after the tax to keep drink prices flat.

But the fundamental problem with this proposal is not the decision to tax a luxury good – public transportation is a vital public good, and Monday’s state budget crisis can remind us that money doesn’t just fall from the sky – it’s that alcohol is the wrong good to tax.

Instead of adding to the convoluted series of taxes we already pay for alcohol, why not tax a good that is contributing to the problem of public transit deficits?

The $2-a-day tax proposal for rental cars offered up by county officials is one solution. Another could be an additional tax on private transportation. Taxing these services would provide a two-fold effect: They could help to fund public transit, as well as encourage people to utilize public transit as an alternative to paying the tax.

Another solution could be tacking an additional fee on to citations for driving under the influence or other alcohol-related misdemeanors. Rather than punishing citizens who choose to consume alcohol, we would be punishing those who abuse it.

We hope the importance of funding public transportation doesn’t get lost in the fury that a drinking tax proposal will likely cause, but instead inspires a public consortium of alternatives.

Because at the end of the day, the only thing worse than over-paying at the bar is having no way of getting home afterward.