EDITORIAL- Empty your wallet: It’s time for college

September 15, 2004

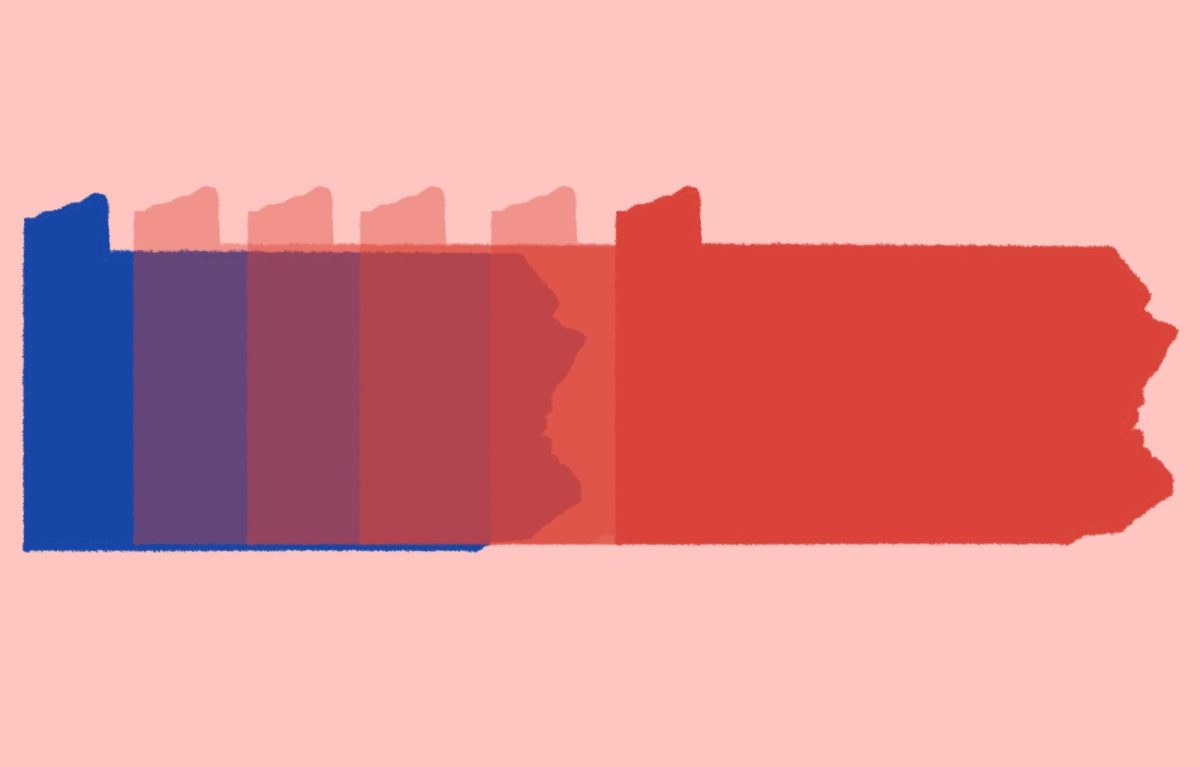

Pennsylvania got its report card yesterday, and Mom is gonna be pissed.

In a study conducted… Pennsylvania got its report card yesterday, and Mom is gonna be pissed.

In a study conducted by the National Center for Public Policy and Higher Education, U.S. colleges and universities got a big, old F in affordability. Fewer students can afford to go to college than could two years ago, even though, with the limping economy and barren job market, a degree matters more now than it did even a scant 24 months ago.

The report, titled “Measuring Up 2004,” rated all 50 states on the familiar A through F scale, and gave a nationwide grade for each of six categories.

Not surprising to anyone who’s gotten a bill recently, Pennsylvania schools flunked in affordability. Then again, only three states ranked above a D in that category, bringing the class average to about an F+. And that’s not going to please anyone’s mom.

This study just confirms what most students know intuitively: college has been costing more and more, with financial aid contributing less and less. In fact, the study refutes other studies, such as one done by USA Today earlier this month, that reported tuition is being offset by financial aid.

As the study reports, net college costs — tuition, room and board, minus financial aid — at public, four-year universities in Pennsylvania consume 52 percent of annual family income. That’s too much. And those costs don’t even cover such luxuries as books, highlighters and real food.

So, now that there’s statistical evidence that we’re all going to go broke, what are we supposed to do? For most people, defaulting on their loans and fleeing the country to our big, cuddly neighbor to the north isn’t an option.

Maybe the government could start holding bake sales — or, more realistically, put funding the machinations of the mind before funding the machines of war.

Students should not be burying themselves in debt to obtain an education. We shouldn’t be held in lien to private loan companies or to Uncle Sam. We should not be giving more than half our families’ incomes to institutions, only to find that the diplomas we’ve worked hard for have diminished in value and that the market is lacking jobs that can sufficiently repay our loans.

Most jobs — ones that won’t soon be outsourced to cheap, overseas labor or replaced by machines — require degrees. Unless the United States’ economy suddenly reverts to subsistence agriculture, this is going to continue to be a problem.

Democratic presidential nominee Sen. John Kerry, D-Mass., has offered a plan that would give $10 billion to the starving state systems, and loan relief for students who become teachers — a plan similar to something from The West Wing, so you know it’s good.

That’s a hell of a lot better than some lousy bake sale — and enough to keep all the states’ moms happy.