Community members urge divestment at open forum

Sarah Cutshall | Visual Editor

Pitt community members voiced their dissatisfaction with Pitt’s Board of Trustees ad hoc committee on fossil fuels at Wednesday’s virtual open forum.

October 30, 2020

Pitt community members voiced their dissatisfaction Wednesday evening with the University investing part of its $4.3 billion endowment in fossil fuels and the Board of Trustees committee now charged with investigating whether Pitt should divest. Danny Doucette, a physics graduate student, said the University needs to re-examine its investment priorities.

“Where is the courage when it comes to the University’s investing decisions?” Doucette said. “Let us not forget that the University of Pittsburgh is an institution of higher education, deeply rooted in western Pennsylvania as an education and research hub, not a Wall Street investment firm.”

Wednesday evening’s virtual open forum — held by the Board of Trustees’ Ad-Hoc Committee on Fossil Fuels — collected community feedback about what the Board should do. Community members took turns expressing their thoughts about the committee and divestment.

Three out of seven committee members attended the forum:

- Dawne Hickton, the committee chair and an executive vice president at Jacobs Engineering Group

- Sundaa Bridgett-Jones, managing director for policy and coalitions at the Rockefeller Foundation

- John Maher III, former representative for District 40 in the Pennsylvania House of Representatives

University administrators that attended the meeting included:

- Hari Sastry, chief financial officer and liaison to the committee

- Aurora Sharrard, director of sustainability

- Kathy Humphrey, senior vice chancellor for engagement and secretary of the Board of Trustees

The committee is tasked with providing a report by Jan. 15, 2021, with options on “whether, to what extent and via what methods the University, in its endowment, should consider divestment from fossil fuels in existing and/or future investments.”

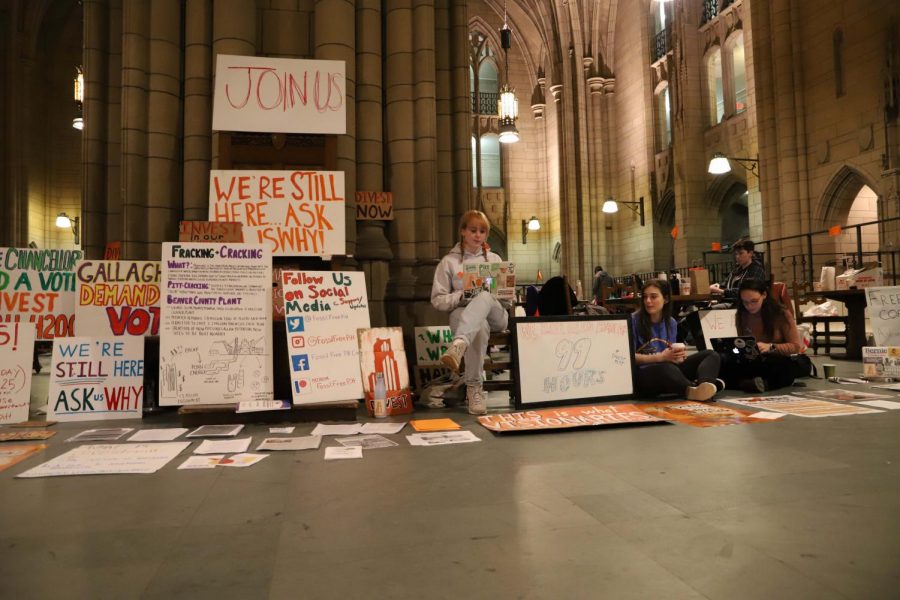

The board formed the committee in June after years of pressure from the student body, including groups such as the Fossil Free Pitt Coalition, who staged a 12-day sit-in at the Cathedral of Learning last spring, as well as a protest at February’s board meeting. The Board of Trustees unanimously approved a formal socially responsible investing process and committed to carbon neutrality by 2037 in February.

At the open forum, Hickton described some of the committee’s work so far. She said since the committee’s first meeting on Aug. 17, it has held five informational meetings with Fossil Free Pitt members, chief investment officer Greg Schuler and socially responsible investment managers from the private sector and Harvard University. Hickton said no formal actions were taken at the five meetings.

Many speakers expressed anger over the Board’s decision to form the committee after the student-led push for divestment. Annalise Abraham, a member of FFPC and Student Government Board, said the board is showing how “out of touch” it is with the community by continuing to delay divestment. Abraham referenced a 2019 SGB referendum where 91% of voting students expressed support for divestment.

“The formation of this committee itself is extremely disappointing to me,” Abraham, a junior environmental studies major, said. “I am not honored to have the opportunity to speak today, and I’m not glad that the Board has decided to hold these public sessions to hear from the community.”

Other speakers cited problems with the board’s lack of transparency and urgency. Nicholas Suarez, a blogger at The Pitt News, said the board isn’t trusting students by keeping its operations secretive. He met with the committee along with other members of Fossil Free Pitt in a private meeting earlier this semester.

“The fact that [the meeting] was held behind closed doors attests to how little the board trusts its students, and how little it cares about their inputs and transparency,” Suarez said.

At the meeting, Suarez said members of Fossil Free Pitt provided Board members five documents regarding divestment and reinvestment to read. He said the documents were posted to the committee’s website with notifications saying ‘read’ next to the documents the committee had looked at so far. At the time of the open forum, Suarez said three of the five documents were marked as unread.

“And all along I thought it was just us students who didn’t do the readings,” Suarez said.

At the time of publication, the website did not list read or unread notifications.

Sharon Yeager, a 1988 Pitt alumna, asked the committee outright what the board’s main objections were to divestment. No committee members responded, instead promptly moving on to the next speaker.

Another concern brought up by speakers was the disconnect between the research that Pitt is conducting and its investments. Robert Nishikawa, a professor in the radiology department, said Pitt has invested millions of dollars into research on climate change, and is one of the leading institutions in studying the impacts of climate change. He said it seems “totally incongruent” for the University to support fossil fuels in spite of its own research.

“These researchers conclude that there will be dire consequences for the state, the country and the world if we continue business as usual,” Nishikawa said. “Either the University believes the research it produces, and acts accordingly, or they should ask themselves, why did they invest millions of dollars in research, just to ignore it?”

Elina Zhang, a member of FFPC, questioned why it should be students putting in hours of work to get reforms made to Pitt’s investing portfolio.

“Should it really be on us students to be doing the work that our University admin should be doing?” Zhang, an MFA student in creative writing, said. “Should the burden of protecting our future really lie in us students?”

Zhang said the FFPC refuses to wait for the Board to continue delaying their decision on whether or not to divest.

“We refuse to wait for the Board of Trustees to delay and delay until it is the most financially opportune time to act,” Zhang said. “The longer public officials and the Pitt community have to wait for administration to arrive at some moral clarity, the more embarrassing inaction will look in Pitt’s history.”