Pitt quietly releases socially responsible investment criteria

Sarah Cutshall | Senior Staff Photographer

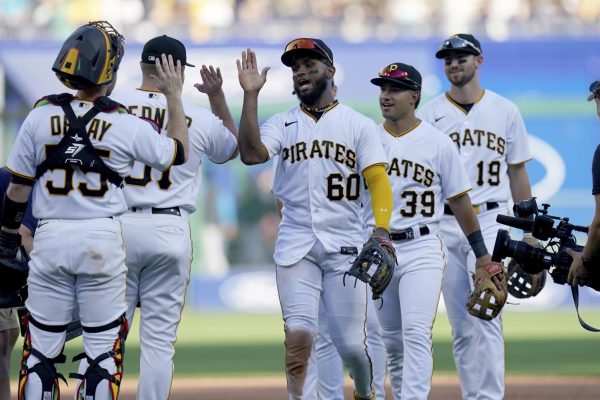

The Fossil Free Pitt Coalition held a sit-in in the Cathedral Learning in February to demand the board of trustees divest from fossil fuels.

June 16, 2020

Pitt quietly released a socially responsible investment policy statement in March, delivering another win to student activists pushing for fossil fuel divestment and endowment transparency.

The Environmental, Social and Governance policy statement for the University’s endowment said ESG factors are a logical and important consideration in thoroughly assessing long-term, risk-adjusted investment returns. Pitt will report annually on these factors, with the first report due in June 2021. The factors include, but are not limited to:

- Environmental: Energy efficiency, hazardous materials management, climate change and water and land management

- Social: Data protection and privacy, human rights, labor standards and product safety

- Governance: Accounting and audit standards, bribery or corruption, business ethics and regulatory compliance

The ESG policy statement’s creation follows a vote at the February board of trustees meeting to establish a formal socially responsible investing process. Chancellor Patrick Gallagher charged Chief Financial Officer Hari Sastry with both of these tasks, after numerous years of advocacy from student groups such as the Fossil Free Pitt Coalition and a chancellor-appointed committee released a report last July examining socially responsible investing.

Annalise Abraham, an FFPC organizer, said incorporating the ESG factors into the investment process is a good move by Pitt.

“It is common sense that the board should take ESG factors into consideration when making investments,” Abraham said

But Abraham added that organizers are more focused on the SRI process approved in February, which would allow the chancellor to formally recognize requests for investment exclusions from the University community. Gallagher can advance a request by either bringing it directly to the Board or creating an ad hoc advisory committee to analyze the possible exclusion. A findings report would then be presented to the Board for possible action.

“We are eagerly waiting and hoping that that will be discussed at the June meeting in a few weeks,” Abraham said. “It is critical that the board move quickly on this because fossil fuels are responsible for the climate crisis — it’s a very time sensitive issue.”

At the time, board chairperson Eva Tansky Blum said she would “immediately consult” with board committee chairs on next steps on divestment. Pitt spokesperson Pat McMahon said board members have begun conversations about divestment, which will continue as Thomas Richards prepares to take the helm as Pitt’s new board chairperson.

“While University leadership is focused on operating effectively while guarding the health and safety of students, faculty and staff during the current pandemic, we have also maintained a focus on long-term sustainability and our goal of achieving carbon neutrality,” McMahon said.