Board fossil fuels committee delivers report

Sarah Cutshall | Visual Editor

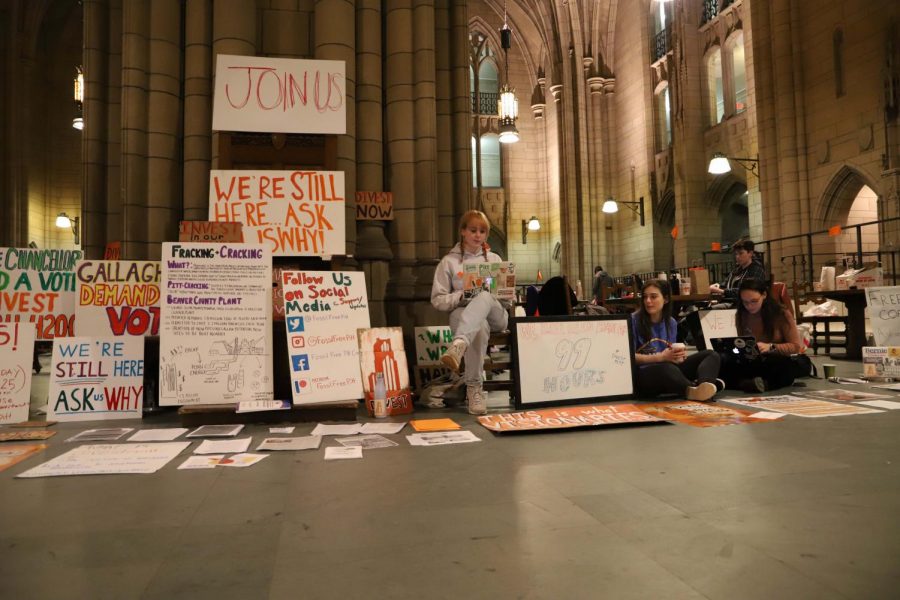

Members of the Fossil Free Pitt Coalition staged a February sit-in in the Cathedral of Learning, calling for fossil fuel divestment.

February 19, 2021

The Board of Trustees’ Ad-Hoc Committee on Fossil Fuels, charged with studying whether and how the University should divest its $4.2-billion endowment of fossil fuel investments, released a 124-page findings report Friday afternoon. The report — which the board will consider at its winter meeting next Friday — did not recommend that Pitt completely divest from fossil fuels in the near future and instead outlined strategies for continuing to reduce such investments.

In studying the investment environment for fossil fuels, the report described it as “increasing risk for lower returns,” and noted that the endowment’s amount of fossil fuel investments has fallen dramatically in recent years. According to the report, fossil fuel investments have dropped by 42% over the last five years, decreasing from 10% of the endowment on June 30, 2015, to 5.8%, or about $243.8 million, as of June 30, 2020.

The committee added that “most” of the remaining investments in the fossil fuel industry are in private equity, which are expected to drop to zero by the end of 2035 as “these investments are liquidated by external fund managers and not replaced with others.”

The steps outlined for the board differ in their approaches — some focus on utilizing and expressing “support” for existing policies, while others center on releasing more details about the endowment and increasing transparency. The report’s options are:

- “Strongly support” implementing the University’s current Environmental, Social and Governance policy and directing endowment management to apply ESG considerations to every endowment investment decision.

- “Strongly support” the endowment’s current long-term investment strategy, which the report said will reduce private holdings in fossil fuel exploration and production to zero by the end of 2035.

- Direct the board’s investment committee to oversee the development of a “long-term” strategy focused on seeking “attractive” investments that “help reduce, avoid and eliminate” greenhouse gas emissions.

- Increase transparency about the endowment, such as through “support” for Pitt’s commitment to release annual ESG reports, which will “highlight” the application of the ESG policy, in particular with fossil fuel investments, as well as “support” for “regular, clear and accessible University communication, education and engagement” about the endowment’s “aggregate status, trends and current and future fossil fuel” investments, including an annual update to the board and University community.

- Not apply a “negative screen” — completely blocking one type of investment — to fossil fuel investments.

The board created the committee through its new socially responsible investing process, following years of pressure from the student body, including groups such as the Fossil Free Pitt Coalition, who staged a 12-day sit-in at the Cathedral of Learning last spring, as well as a protest at last February’s board meeting. In writing the report, the committee talked with Pitt financial officials, various subject matter experts and hosted two open forums last October and November to solicit input from the University community.

FFPC purchased a South Oakland billboard, which went up Monday evening, to encourage the committee to release its findings and Pitt to divest from fossil fuels. The billboard features two eyes and the words, “PITT THE WORLD IS WATCHING, DIVEST NOW.” Many candidates running for Student Government Board in the upcoming March 2 elections have posted pictures of themselves by the sign.

The coalition said in a statement that the committee and its report were another stalling tactic by the University and that the administration isn’t fulfilling its “moral and fiduciary responsibility.”

“We have repeatedly called out the University for failing to divest from fossil fuels and instead they create more committees and reports and take up valuable time and energy,” the statement said. “After reading their report, we know that despite the fact that Pitt is well aware of the community’s overwhelming support of divestment and the financial precarity of fossil fuel investment.”

The statement also said that leading up to next week’s board meeting, FFPC will “continue to ramp up” its fight for divestment.

The report also said the University’s investment strategy is “only a small piece” in how it “considers, approaches and impacts” issues that include ESG approaches, such as climate change and fossil fuels. It pointed to past efforts such as University sustainability initiatives, a unanimous vote from the board last year to commit to carbon neutrality by 2037 and a “climate action plan” to be released soon.

Community members can submit feedback to the committee through next Tuesday.