For many of us, going off to college pretty much means absolute freedom from your parents. No one is telling you to clean your room or do chores. You’re kind of on your own now. While that may seem great — and it definitely can be — being on your own also comes with more responsibilities. One of the most important things to learn is financial responsibility. Yes, I know this is not a fun or exciting topic, but it will be super helpful in the long run. Going into my last year here at Pitt, I can attest to this. Here are some of my tips and advice and what I’ve learned about personal finances since coming to college.

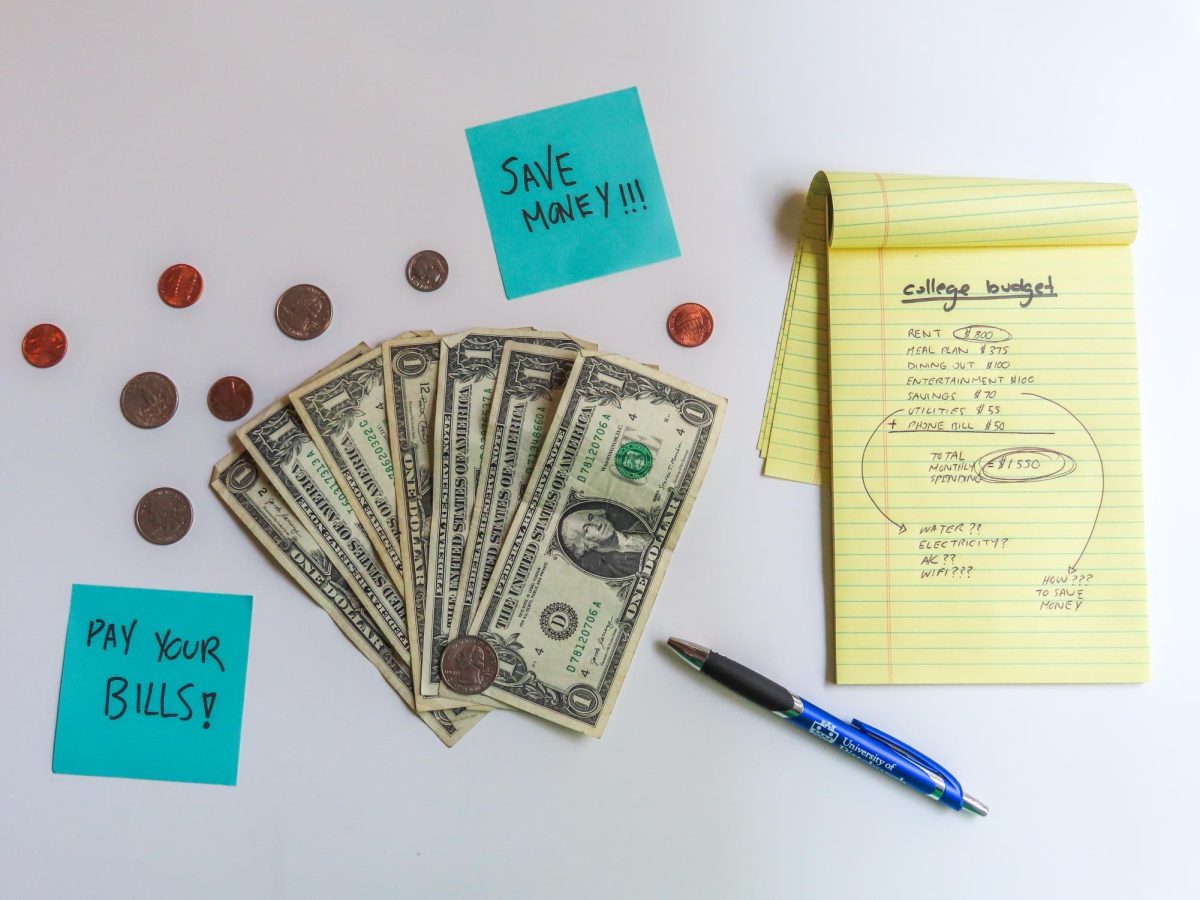

Bills and utilities come first!

This is a really important part of learning how to budget your money. If you are living off campus, this is super important. If you have your own credit card, this is also for you. Make sure you have enough money every month to pay those off first. This might mean limiting how much you spend on the non-essentials. I still need to remind myself of this every once in a while, but it has definitely helped me keep a good credit score — which is going to be super, super important in the real world, so you might as well start early. As someone who has always lived with roommates in college, paying your share of the utility bills on time is a good habit to start building up. Not doing so can make you seem like an unreliable person to live with and can lead to roommate conflicts and possibly splitting up.

Understanding your credit card.

Going off of my previous point about building up a good credit score, you first need to understand how a credit card works. I’m super grateful for my parents teaching me these things when I was 16 and making me an authorized user under my mom’s credit card. When I got my own at 18, it boosted my credit score right away because my mom managed to keep a great credit score. I would highly suggest opening a credit card right after you turn 18, or at least soon after. The most common one students have is the Discover Student Card. This is a really great way to start building up your credit, and you get many perks, such as cash back from purchases and earning rewards and gift cards.

No matter which credit card you end up with, these things are super important to remember. Always pay off your credit statement on time, and don’t exceed your credit limit. These are some of the things early on that will really affect your credit score. This might mean cutting down on eating out. If you have a dining plan — Panther Funds and dining dollars included — try to use those up first before spending your actual money. One really helpful thing I’ve learned was to pregame at home. This saved me so much money at bars, where drinks will add up super fast, and suddenly you’ve spent more than you planned.

Make sure you have some emergency savings.

This one really came in handy for me. Try to have at least a few hundred dollars in your savings account in case anything comes up — such as a medical emergency. This saved me my freshman year when I had to get a procedure done. I had bad out-of-state insurance at the time, so naturally, none of it was covered. I had to pay $745 out of my own pocket for the procedure. Yes, my bank account took a hit, but it was definitely better than the alternative of being in pain constantly. I’m not saying that serious medical emergencies will be super common in college, but you should always be at least somewhat prepared. Having some backup money can save you a lot of trouble. While the “student health fee” charged with the rest of our college tuition does cover some basic health services and counseling, it is not the same as insurance. More advanced or serious health services are not covered by the fee. They would usually charge those to your insurance instead. For places like UPMC, the best way would be to contact them directly, as insurance companies usually all have different providers they do and don’t cover.

Take advantage of student discounts and sales

If you love shopping as much as I do, then you understand how quickly you can blow through all your money on things you probably don’t need. Sales and student discounts are super handy. American Eagle and Aerie offer 20% off for students, e.l.f Cosmetics also offers 20% off and Converse offers 10% off. There are many more brands that offer similar discounts to students. Places like Victoria’s Secret, Bath and Body Works and Gymshark have a massive semi-annual sale — one during the summer and one in the winter. Many brands have big sales around these times too. Those are the best times to buy whatever you want or need. Try to avoid buying anything at full price because chances are, in a few months, they’ll have some sort of discount.

Student discounts are also a lifesaver. Student Beans and UNiDays offer discounts to numerous online and in-store retailers. You really shouldn’t settle on paying full price at massive retail stores, because the chances of them having some sort of lesser-known sale or discount is so high.

Kelly Xiong primarily writes about fashion and current social issues. You can reach her at [email protected].