Combatting the influence ESPN, sports networks have on cable

March 16, 2014

Cable providers have always seemed to arbitrarily raise their costs at the expense of nonconsenting consumers, but why are cable bills getting so costly?

The average price of cable has risen to more than $78 since 2001, when cable bills were $48 on average. Surprisingly, it’s not solely the voluntary movement of our cable providers, but rather, it’s the television networks that have the most influence on cable bills. Namely, sports networks such as ESPN have a significant influence in the high prices they charge cable companies to broadcast their services. This places the burden on cable companies to make up the difference, ultimately funnelling customers into paying for a service they might not even want. Since consumers already have a limited choice in buying cable or not having it altogether, what each consumer pays for is even less of their decision.

First it is important to understand how the payment hierarchy works in the television industry. The average consumer pays a monthly fee to a cable provider, such as Comcast or Time Warner Cable. Cable companies establish their prices largely based on the subscription fees that television networks and channels determine. Subscription fees are calculated per customer, so for non-sports channels such as CNN and MTV, they charge $0.57 and $0.39 per month, respectively. For the larger, more recognized sports channels such as Prime Ticket and Sports Net, costs are $2.36 and $3.95, respectively.

Before anything, how much does ESPN charge cable companies compared to other channels? ESPN charges $5.13 per month, or 20 times more than the average cable channel. That’s more than CNN, MTV, FX, TBS, CNBC, AMC, Nickelodeon, Comedy Central, The Food Network and Discovery Channel combined.

Two issues arise regarding ESPN’s freedom to raise its subscription fees and its inhibition on the consumer choice. One, ESPN and its parent company, Disney, can only be subscribed to in one package, limiting cable companies to choose either both or none; and two, given the monopoly ESPN has in providing a variety of sports, whether a consumer wants to see only basketball or baseball, they pay for all of the sports ESPN offers.

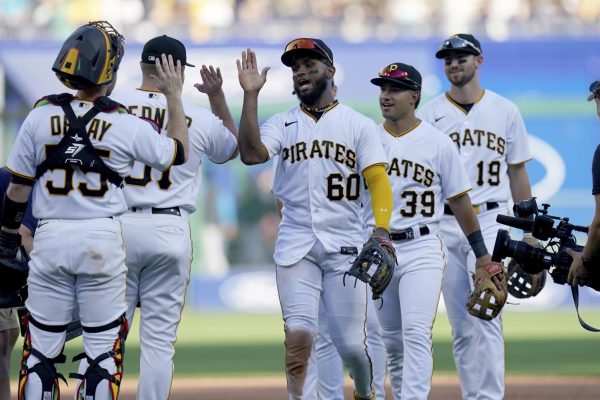

In light of the NCAA Tournament and the month-long behemoth of college basketball many of us will enjoy, numerouscable bills will rise much to either our willful consent or ignorance. While cable companies might not have the most freedom to determine how much television networks charge, they still profit from the freedom television networks have with rising subscription fees. The only way it seems possible to cap rising cable bills is for consumers to unplug and find an alternative, but that’s easier said than done.

Granted, ESPN is a television network with a large broadcasting contract with a variety of sports organizations, including the NFL, MLB and NASCAR, which influences how much their subscription costs. ESPN is also unlike many other singular channels and its respective networks, providing a number of channels and services in real time as opposed to the competitors who largely offer prerecorded entertainment. But are similar, comparable networks charging just as much?

For one, The Disney Channel charges a subscription fee of $1 per month. Disney, a corporation that offers a measurable assortment of programs for children to teenagers, is an example that leads the non-sports category in terms of highest subscription fees.

As noted earlier, Disney is the parent company of ESPN and both are often paired in network deals, so when cable providers pay to provide ESPN for their customers, they also have to pay for the Disney Channel. This is the case conversely, meaning consumers pay for both subscription fees whether they want to or not. This pairing, rather than the consumer himself, evidently decides what the consumer pays for. Television networks like ESPN and cable companies further inhibit consumer choice because of the monopolization of the industry: Comcast, Walt Disney, Viacom, CBS, News Corporation and Time Warner are the television superpowers that have overwhelming reaches on what the average American consumer of cable television watches and pays for.

What is more, sports organizations and teams also have profitable stakes in what television networks broadcast. The Big Ten athletic conference owns 51 percent of the B1G Network, and the New York Yankees own a large portion of the YES Network. This means that while there are contracts for cable companies and sports networks, sport organizations are also profiting from their coverage on television.

The Los Angeles Dodgers just partnered with Time Warner Cable to create a new channel that will only broadcast their baseball games. This means that Los Angeles residents will now have one channel strictly for Lakers and Dodgers games, each channel carrying subscription fee of about $4.00.

Zooming back out, whether average customers want to only watch their favorite sitcom, or any other program, they are probably getting — and paying for — other networks they did not choose.

Given this lucrative model that benefits not only cable providers and television networks, but sports organizations in some cases, it is hard to believe non-sports-watching customers will ever gain any headway in stunting the costs of cable bills.

So, what are solutions to the inhibition of consumers by the doings of sports packages? Well, admittedly, consumers who have cable packages are exploited not only by sports packages — sports packages just happen to be the most exploitative. One solution could be relying on Google, Apple, Netflix and Hulu to create cheaper alternatives to cable — and they have to some degree. But a large component is that sports packages, primarily ESPN, provide live sports coverage like few other alternatives, which is what some of these companies fall victim to.

The other solution would be to have consumers unplug entirely. This trend has merit: Over the past year, 1.8 million people ended their cable television subscriptions, which is almost double the amount who did so the previous year. If more people decided to terminate their contracts with their cable providers, it is possible that a cap of some sort would be installed to contain the rising costs of providing sports to cable consumers. This would also prompt innovators to pick up those nonconformists, which could lead to services like Google TV, Apple TV and Xbox and compete with cable television.

Undeniably though, the prices of sports packages must come down. The content is widespread, yes, but the pockets of the consumers willing and unwilling to use and pay for these services are not getting deeper.

The best way to enhance the choices of the consumers is by having cable packages follow a build-your-own model. Granted, sports organizations, cable providers and television networks all have little to no incentive to do so, and so it should be the consumers choice to deny cable in order to find the best alternative.

While current alternatives lack some of the amenities that cable provides, they aren’t far behind. So for consumers who await the madness of March, or for those who prefer the comfort of their respective sitcom, you don’t have to be subject to the limited choices of cable television. There are plenty of cheaper, personalized alternatives for each consumer.

Write Ankur at [email protected].