Op-ed | Commendable ESG reports will need transparency

Sarah Cutshall | Visual Editor

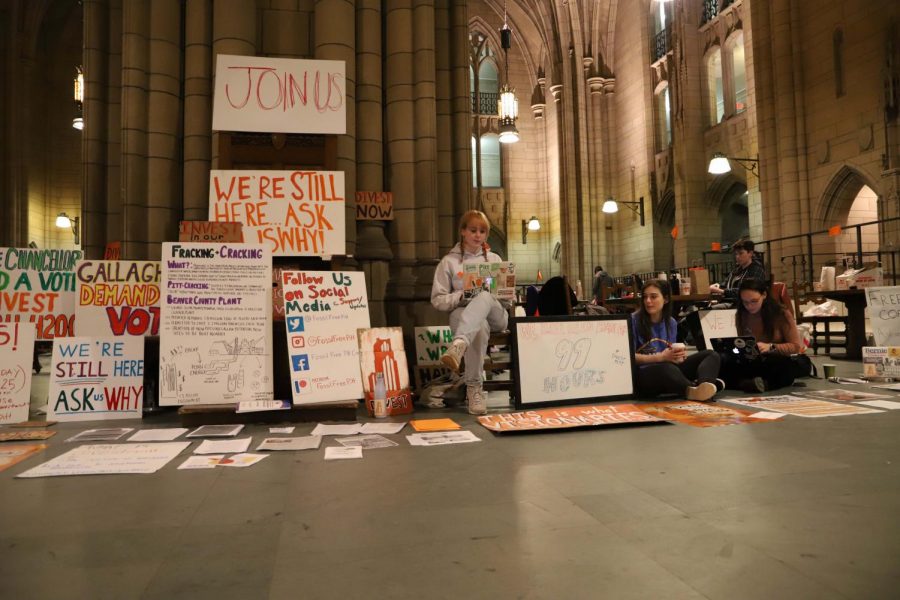

Members of the Fossil Free Pitt Coalition staged a February sit-in in the Cathedral of Learning, calling for fossil fuel divestment.

June 16, 2020

Without much fanfare, Pitt’s chief financial officer released a policy statement in March outlining how the University intends to recognize Environmental, Social and Governance principles in managing its $4.3-billion endowment.

Chief Financial Officer Hari Sastry, Chief Investment Officer Greg Schuler and the Office of Finance should be commended for the policy statement, which affirms that ESG principles are “a logical and important consideration” to inform investment decisions related to the University’s endowment. The need to align Pitt’s investment policies with its mission to “contribute to social, intellectual and economic development in the Commonwealth, the nation and the world” has never been more clear than this past February, when hundreds of students from the Fossil Free Pitt Coalition took action to spur divestment from fossil fuels.

Divestment is a process of selling off investments and screening new investments in companies responsible for environmental or social harm in order to stigmatize those companies and reduce their operating capital. Fossil fuel divestment is largely the consensus at Pitt, where students, faculty, staff and the community are increasingly worried about the impact of climate change: 91% of students who voted in a 2019 referendum were in favor of fossil fuel divestment, as did 53 out of 58 participants in socially responsible investing forums held in 2018.

Thus, while support for fossil fuel divestment is both strong and widespread today, the idea of strategic investing is not new. Pitt student activists won a years-long campaign in the ’80s to force Pitt to divest from companies that operated in apartheid South Africa. There was also a push in 1997 from faculty to divest from tobacco stocks, as the link between smoking and lung disease became clear. Meanwhile, Downtown, the City’s pension board continues to move forward on divestment from gun manufacturers, private prison operators and fossil fuel companies.

But unlike Pittsburgh’s pension board, Pitt has been tight-lipped about where it’s putting its money. That’s common practice in the competitive world of investing, but secrecy undermines the logic of divestment, which aims to make “sin stocks” of fossil fuel companies while publicizing and reinvesting in undervalued, innovative and community-based initiatives. In this respect, the most exciting aspect of the new ESG policy is the promise of an annual report — the first of which is due June 2021.

The publication of a transparent report doesn’t just amplify the effects of strategic investing — it also increases confidence in the Pitt community that the University’s vast reserves are being used for the betterment of our world and our communities. Such confidence will surely have a positive impact on enrollment, community goodwill and alumni giving. We deserve better than to learn about our University’s investments from leaked documents, as happened when the Paradise Papers revealed that, as of 2017, Pitt had $26 million invested in EnCap, a fund that primarily provides venture capital to fossil fuel companies.

I urge the chief financial officer and his staff to make the ESG reports as transparent as possible about the specific investments of Pitt’s Consolidated Endowment Fund. If Pitt has investments in a myriad of consolidated investment vehicles, those constituent investments should be accounted for so that the Pitt community can understand where our University puts its money. Simply put, tell us who has their hands on our money. Exposure in the investment portfolio to fossil fuel, tobacco, weapons and private prison companies should be tabulated and presented clearly, using either Morningstar or publicly available lists such as the Carbon Underground 200 and Weapon Free Funds.

Reinvestments, which should be made in consultation with stakeholders like the Fossil Free Pitt Coalition and the Pitt community, should also be outlined in the report. As a community, we need to reckon with the just transition that must follow from divestment. The CFO’s office will have the opportunity next year to release a transparent and thorough ESG report that brings our community together and is true to our values. That’s a report I’m looking forward to reading.

Danny Doucette is a Ph.D. candidate in physics and a supporter of the Fossil Free Pitt Coalition.