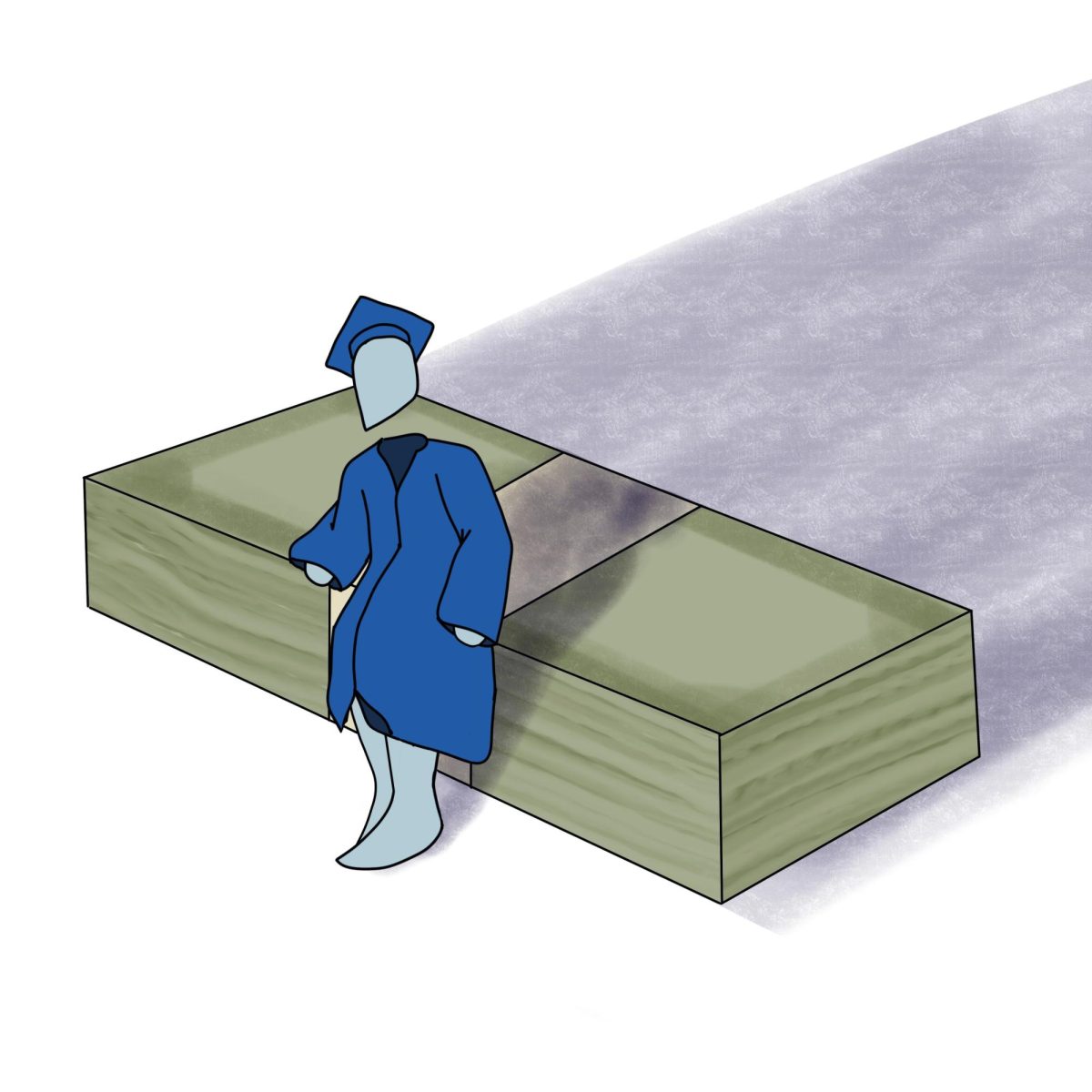

Between tuition, fees, and all other kinds of expenses, affording college can be a difficult task.

Joel Philistin, director of financial wellness at Pitt’s Center for Financial Education and Wellness, said, for many, a “lifetime” of making financial decisions begins in college when students lease their first apartments, establish credit cards, borrow student loans and more.

“Making financial decisions without foundational knowledge can be stressful and impact students well after graduation,” Philistin said. “By caring about their financial well-being now, students will position themselves to meet their day-to-day expenses and use their finances to accomplish their goals.”

Since 2021, tuition and fees for undergraduate students at Pitt have increased annually. This year’s increases raised tuition by approximately $400 per year for in-state students and $2,500 per year for out-of-state students.

Philistin said the Center for Financial Education and Wellness helps prepare students for their financial journey through weekly presentations, one-on-one appointments and online learning.

“Along this journey, key concepts like budgeting, saving, managing credit and debt, and investing are a part of the journey,” Philistin said.

To ensure a bright financial future, Philistin recommends opening a bank account, creating a budget, spending thoughtfully, being wary of identity theft and establishing a good credit score. He said having a bank account provides a safe place to store your money, but tells students to keep an eye out for potential fees.

“Be careful with overdraft fees and minimum balance requirements,” Philistin said. “These are fees that can cost you if you are not monitoring how much you have to spend.”

Once you have a bank account, Philistin recommends creating a budget, calling it “the most important financial foundation.” He said identifying your wants and needs and budgeting for entertainment will help avoid impulse purchases and lead to more thoughtful spending.

“Budgeting will allow you to see what funds you have and where your money is going. It is your roadmap to managing your finances now and in the future,” Philistin says.

Beyond budgeting, Philistin advises students to take precautions to avoid identity theft. This involves only using secure Wi-Fi networks, keeping passwords private, shredding documents with sensitive personal information, screening phone calls and checking ATMs for “skimmers” — devices that can send financial information to unintended parties.

“Scam artists are particularly good at what they do,” Philistin said. “Remember, it’s better to be safe than sorry.”

Other resources he recommends are GradReady and LinkedIn Learning for financial wellness information, the Department of Education’s Loan Simulator for calculating and choosing loan repayment plans, Pitt’s Community Assistance Resources for meeting any student’s basic needs and PITT ARTS for affordable entertainment options.

Looking toward the future, Philistin emphasized the importance of building a good credit score.

“Establishing a good credit score has benefits such as lower interest rates and better terms. A good credit score shows trust, so you may have a better chance to secure a loan later on in life for those big items such as a house or a car,” he says.

Braeden Marburger, vice president of the Undergraduate Finance Club, said establishing credit early is “extremely important.” Marburger said the club brings in guest speakers from a variety of finance fields to talk about their day-to-day lives and help students get an understanding of what life in finance is like.

“Definitely get a credit card,” Marburger, a senior finance major, said. “Putting a small purchase on it every month, paying it off in full, and not getting too close to your credit limit cause that’ll negatively affect your credit score.”

Marburger also said creating an emergency fund and saving money now will pay off in the future.

“If you can put some money away now and just let it work, you don’t have to worry about it,” Marburger said. “Just put it away in a separate account, and over time, like you might not have much now, but it just keeps building and building and in like 10 years, it’s gonna turn into a lot more than you think it’ll be.”

Charlie Waggoner, president of the Undergraduate Finance Club, said creating and following a budget has helped him spend smarter. His budget tracks expenses for food and groceries, gas, rent, housing costs and going out.

“I think a big trend among students is to kind of like, during the week you’re trying to save up your money and you’re making better decisions, then the weekend rolls around and you spend a lot more,” Waggoner said. “I know that’s at least for me and my friends, and I think the best way to kind of combat that is making these budgets. That way you’re really looking back on it and realizing what areas you improve on.”

Waggoner tells students to have fun, but be thoughtful when spending money.

“I think it’s important to enjoy college while you’re here, but don’t put yourself in a poor situation,” Waggoner said. “I am a little bit frugal, but like I said, I’m still trying to enjoy my time in school.”